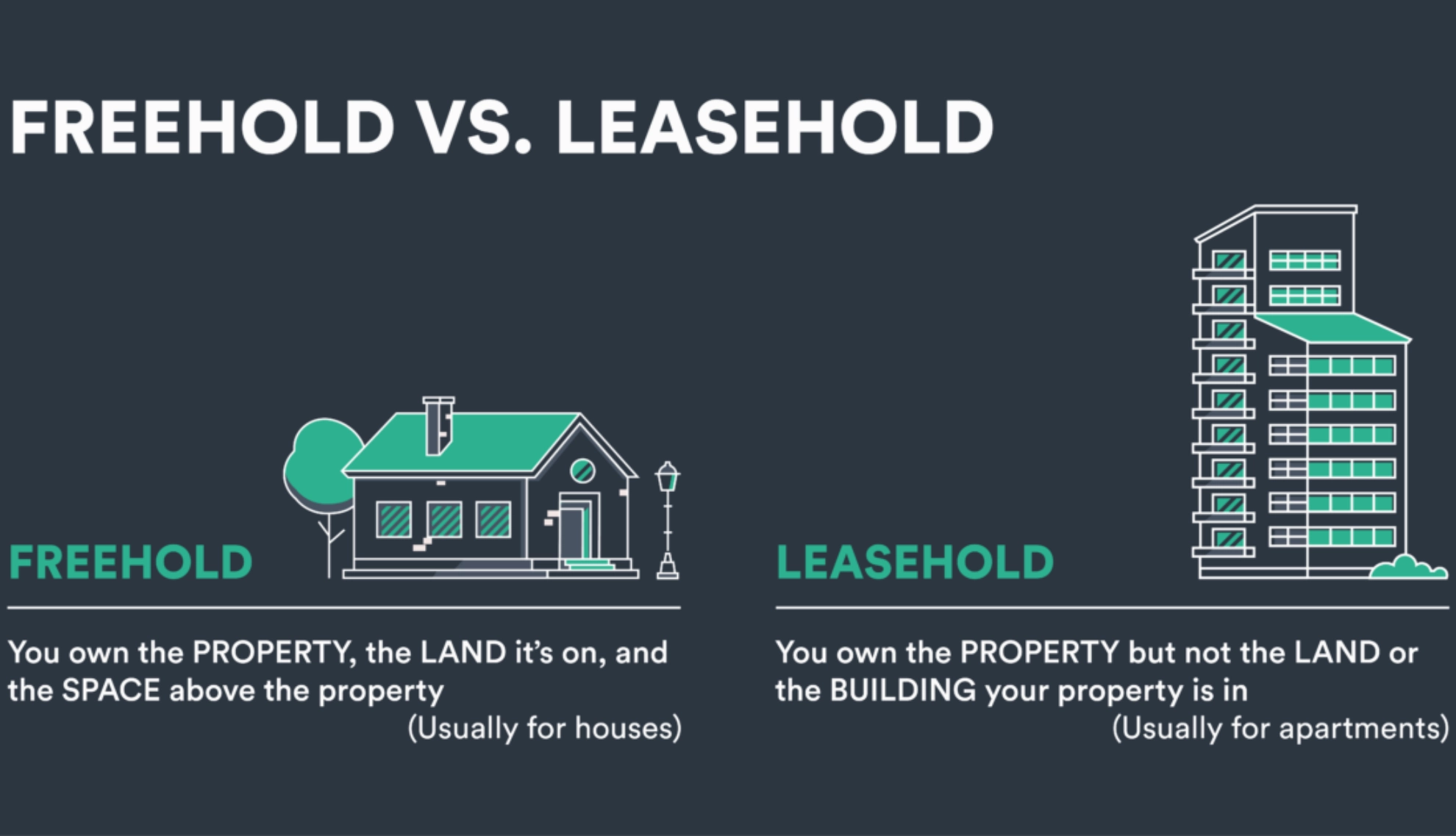

When buying property, one of the first legal concepts to understand is whether the property is freehold or leasehold. These terms define how you own the property and what your rights and responsibilities will be as the owner. Whether you're a first-time homebuyer or a seasoned investor, understanding the distinction between these two types of ownership is critical.

In this blog, we’ll break down the key differences between freehold and leasehold properties, and what each means for you as a buyer.

What Is Freehold Ownership?

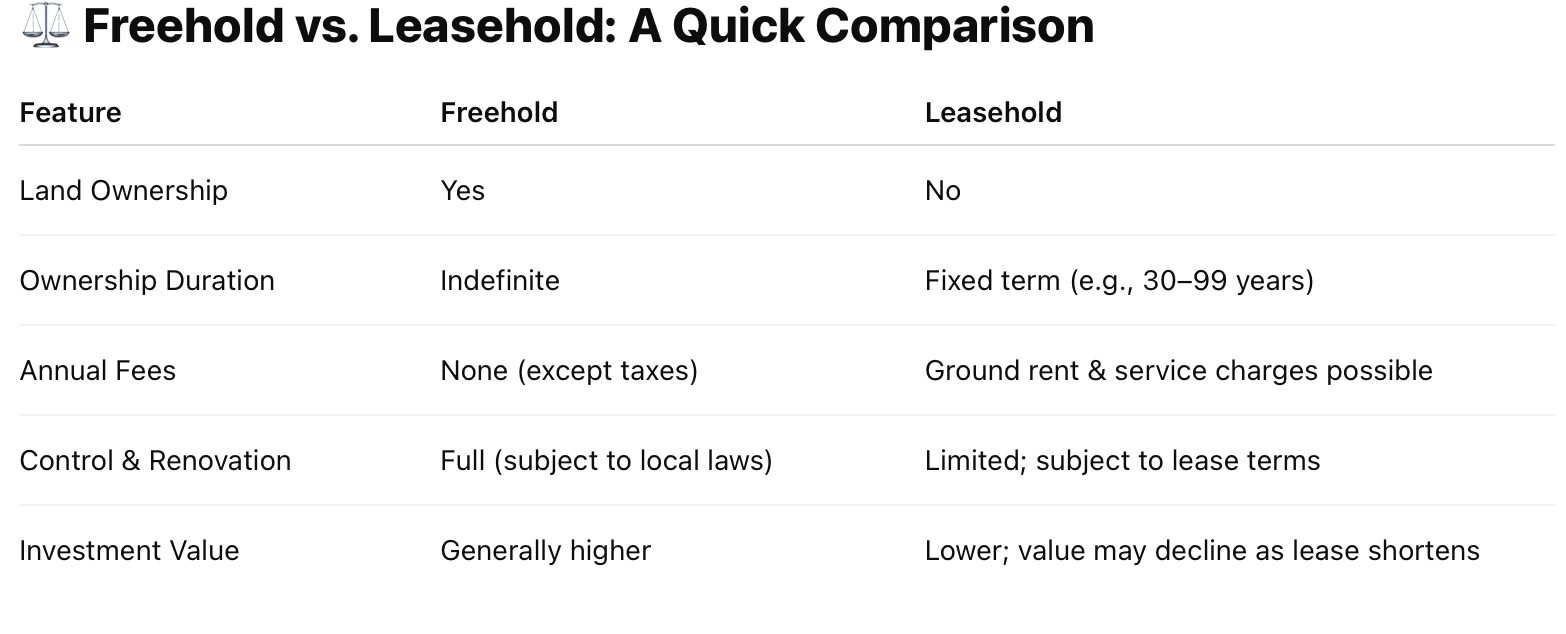

Freehold means that you own both the property and the land it sits on — indefinitely. This is the most complete form of property ownership and typically comes with fewer restrictions.

Key Features of Freehold:

You own the building and the land.

Ownership is permanent unless you decide to sell.

No ground rent or lease payments.

Fewer limitations on renovation or property usage (subject to local regulations).

Full responsibility for property maintenance.

Freehold is especially appealing for buyers who want long-term control and investment security. It is the most common type of ownership for detached houses and villas.

What Is Leasehold Ownership?

Leasehold means that you own the property, but not the land it sits on. Instead, you lease the land from the freeholder (landowner) for a set number of years — typically between 30 to 99 years, and sometimes longer.

Key Features of Leasehold:

You own the structure, not the land.

The lease has an expiration date; you may need to renew it or return the property.

You may be required to pay ground rent, service charges, or maintenance fees.

There may be restrictions on renovations or subletting.

The property reverts back to the freeholder when the lease expires (unless extended).

Leasehold is common in apartment buildings, resorts, or properties within large developments where shared infrastructure and amenities are managed collectively.

Which Type Is Better for You?

The answer depends on your goals, budget, and how long you plan to own the property.

Choose freehold if you want full control, permanent ownership, and fewer limitations.

Choose leasehold if you’re buying in a city, want lower upfront costs, or don’t mind shared amenities and responsibilities.

Before purchasing a leasehold, always review:

The length of the remaining lease

Any fees or obligations

The terms of renewal or resale

In some cases, leasehold properties may offer better access to shared facilities, urban locations, or managed maintenance, making them attractive to specific buyers or investors.

Final Thoughts

Understanding the difference between freehold and leasehold ownership is essential for making informed property decisions. Whether you’re buying a family home, a vacation flat, or an investment property, knowing what you're buying — and for how long — helps avoid future complications.

Always consult with a real estate lawyer or property expert to ensure your ownership rights are clearly defined and protected.