What happens when one of the world's largest economies imposes steep tariffs on another? Why did the Trump administration decide to levy a 30% tariff on European Union goods starting August 1? How will this impact businesses, consumers, and international relations? These questions are at the heart of a brewing trade conflict that could reshape global commerce.

The Announcement and Its Immediate Implications

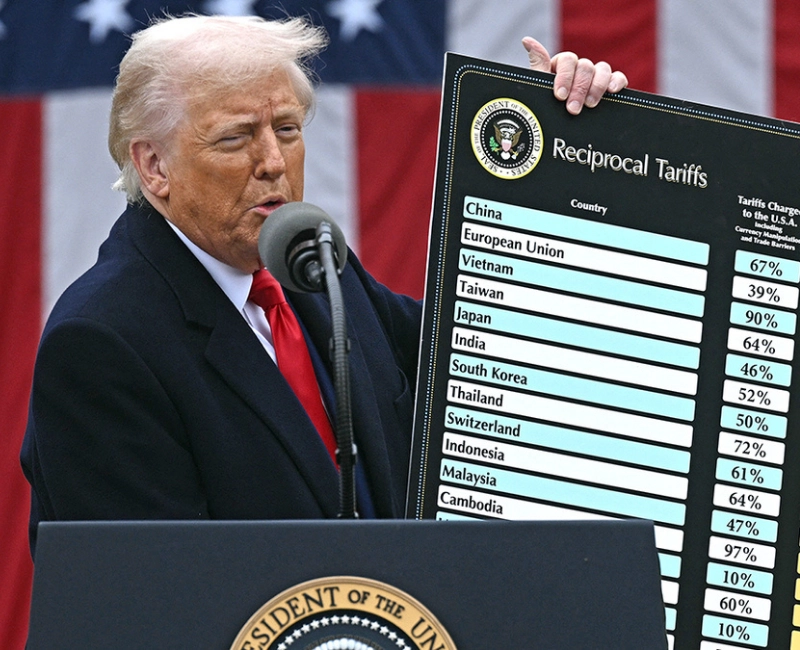

On July 30, 2023, former U.S. President Donald Trump declared that the European Union would face a 30% tariff on select goods beginning August 1. This decision came as part of an ongoing trade dispute between the U.S. and EU, primarily focusing on aerospace subsidies and agricultural products. The move is seen as an escalation of tensions that began during Trump's presidency and have continued to simmer.

The tariffs will primarily affect key EU exports such as wine, cheese, olives, and machinery. For example, French winemakers—who export nearly $2 billion worth of wine to the U.S. annually—could see a significant drop in demand due to higher prices for American consumers.

This policy shift follows years of back-and-forth negotiations, with the U.S. arguing that EU subsidies to companies like Airbus create an unfair advantage. The EU, meanwhile, has retaliated with its own tariffs on American products like bourbon and motorcycles.

Historical Context: U.S.-EU Trade Relations

The U.S. and EU have long been intertwined economically, with trade volumes exceeding $1 trillion annually. However, tensions have periodically flared, particularly during the Trump administration's "America First" era. The Boeing-Airbus dispute, which began in 2004, remains a central flashpoint.

In 2019, the World Trade Organization (WTO) authorized the U.S. to impose $7.5 billion in tariffs on EU goods after ruling that illegal subsidies were given to Airbus. The EU responded with tariffs on $4 billion worth of U.S. products in 2020. Trump's latest announcement suggests a return to hardline tactics after a brief pause during the Biden administration.

For businesses, this uncertainty creates challenges. German automakers, for instance, have already faced volatile export conditions due to shifting U.S. policies. A BMW executive recently noted, "Long-term planning becomes nearly impossible when tariffs change overnight."

Potential Consequences for Global Markets

Impact on Consumers

American shoppers may soon notice higher prices for European imports. A 30% tariff on Italian Parmesan could raise prices by $5-$8 per pound, while French wines might see 20-30% markup. This comes amid already high inflation in the U.S., potentially squeezing household budgets further.

Business Supply Chains

Manufacturers relying on EU components face tough choices. A Midwestern machinery plant using German steel parts might need to absorb costs or seek alternative suppliers—a process that can take years. Smaller businesses lacking bargaining power could be hardest hit.

Financial Markets React

Following the announcement, the Euro dipped 0.6% against the dollar, while U.S. agricultural stocks rose on expectations of reduced EU competition. Analysts warn prolonged tensions could dampen investor confidence in transatlantic trade.

Political Ramifications and Diplomatic Fallout

The tariff decision arrives amid delicate U.S.-EU relations. European Commission President Ursula von der Leyen called the move "deeply regrettable," while French President Emmanuel Macron warned of "proportional responses." Some speculate this could strengthen EU-China trade ties as Europe diversifies partnerships.

Domestically, Trump frames the tariffs as protecting American jobs. However, economists note that trade wars often create winners and losers—while steelworkers might benefit, bourbon exporters and auto workers could suffer from EU countermeasures.

A practical example: Harley-Davidson previously shifted some production overseas to avoid EU tariffs, demonstrating how trade policies can directly influence corporate decisions.

Possible Outcomes and Future Scenarios

Several paths could emerge from this development:

- Negotiated Settlement: Both sides return to talks, possibly leading to reduced tariffs if concessions are made on aerospace subsidies.

- Escalation: The EU imposes matching tariffs, potentially targeting U.S. tech firms or agricultural exports.

- WTO Intervention: Lengthy legal battles at the World Trade Organization might eventually force compromise.

- Supply Chain Shifts: Companies permanently reconfigure supply chains to bypass tariffs, reducing transatlantic trade volumes.

Historical precedent suggests trade wars often end in negotiation. The 2018 U.S.-China conflict resulted in the "Phase One" deal after two years. However, the unique political dynamics of an election year add unpredictability.

Expert Opinions and Economic Analysis

Economists are divided on the long-term effects:

- Pro-tariff analysts argue they protect strategic industries and force trading partners to reform unfair practices.

- Free-trade proponents cite studies showing tariffs ultimately cost consumers more and disrupt efficient global supply chains.

A 2022 Peterson Institute study estimated that previous Trump tariffs cost U.S. households $1,200 annually on average. However, some domestic manufacturers have benefited—U.S. steel production capacity grew 15% from 2018-2021.

The coming months will reveal whether this tariff move proves temporary or marks a lasting shift in U.S. trade policy. Businesses and investors should prepare for continued volatility.